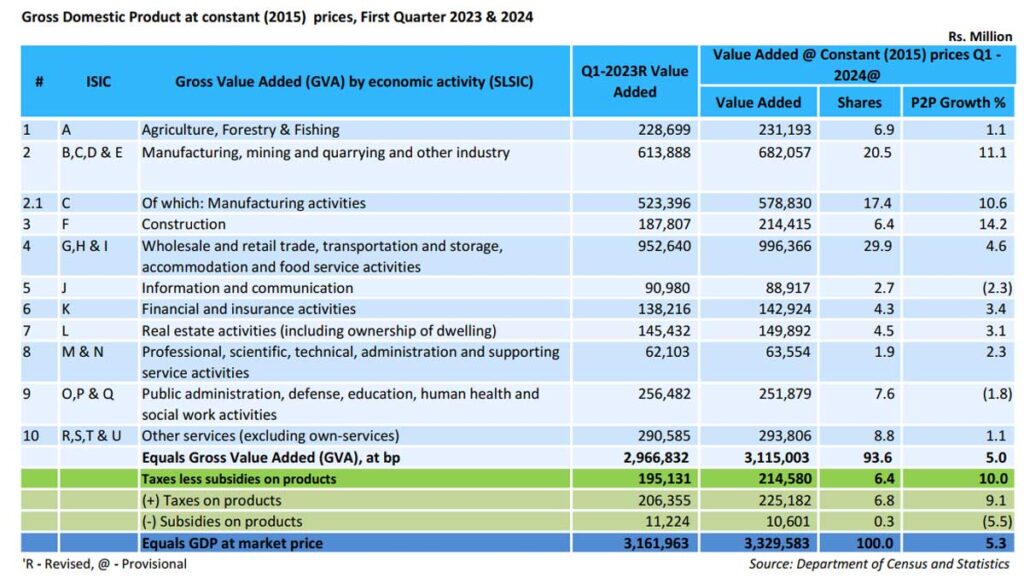

Sri Lanka’s gross domestic product grew 5.3 percent in the first quarter of 2024 data from the state statistics office showed as the central bank continued to refrain from generating monetary instability.

Instead of printing money to cut rates under ‘flexible inflation targeting’ and printing money to boost growth by taking into account ‘potential output’ as permitted by its new monetary law, the central bank ran deflationary policy and also allowed the rupee to appreciate.

“The Sri Lanka economy experienced a more favorable economic condition[s] in the first quarter 2024, when compared to the first quarter in the year 2023,” the Department of Census and Statistics said.

“The high inflation had prevailed in the first quarter of year 2023, gradually reduced to a lower level by the first quarter of 2024 and this low inflation incentivized the economy by providing inputs at [a] much lower price.

The agriculture sector grew 1.1 percent in the first quarter of 2024, after also growing 1.6 percent last year.

Industry grew 11.8 percent in the first quarter, against a 24.3 percent last year.

The economy grew amid falling prices, the statistics office said in sharp contrast to the Anglophone macroeconomic claim that inflation is needed to boost growth, on which Sri Lanka has 5-7 inflation target has apparently been set.

“Among ‘Industrial activities’, coinciding with the decline in input prices, the ‘Construction industry’ grew by 14.2 percent, parallel to this, the ‘Mining and quarrying’ industry too expanded by 18.3 percent during this quarter,” the Statistics Department said.

Sr Lanka’s services sector grew 2.6 percent, against a decline of 4.6 percent recorded last year.

The International Monetary Fund has also urged the central bank to give priority to stability.

Sri Lanka dropped the stability mandate in the earlier monetary law which was violated after the end of a civil war to push the country into serial currency crises especially after the International Monetary Fund gave technical assistance to calculate potential output.

Related Sri Lanka has a corrupted inflation targeting, output gap targeting not in line with monetary law: Wijewardena

Sri Lanka survived a 30-year civil war by giving priority to a stability mandate despite shortcomings in its operational framework but defaulted in peacetime amid activist monetary policy which denied monetary stability to the people.